Register for ACCA Course!

Let’s get started

About ACCA Course

ACCA stands for the Association of Chartered Certified Accountants. It is a UK-based syndicate/group of qualified professional accountants. The ACCA is the largest confederation of accounts professionals with a whopping 228,000+ members and counting alongside an additional half a million students enrolled. The ACCA certification is accepted globally for the high standards and quality of the course that includes a myriad of professionally oriented developmental activities.

Note: Students who have cleared their class 10 examinations, or do not qualify as per the criteria above, can still register for the ACCA Course via the Foundation in Accountancy (FIA) route.

Why ACCA Course?

3 Papers

ACCA Applied Knowledge

- Business & Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

6 Papers

ACCA Applied Skills

- Corporate and Business Law (LW)

- Performance Management (PM)

- Taxation (TX)

- Financial Reporting (FR)

- Audit & Assurance (AA)

- Financial Management (FM)

4 Papers

ACCA Professional Level

Essentials:

- Strategic Business Leader (SBL)

- Strategic Business Reporting (SBR)

Options (Pick any Two):

- Advanced Financial Management (AFM)

- Advanced Performance Management (APM)

- Advanced Taxation (ATX)

- Advanced Audit & Assurance (AAA)

| Qualifications | Number of exams | No of exemptions | Duration to complete | Scholarship |

| High School | 13 Exams | None | Three year | Rs 9,800 /- |

| B.Com | 8 Exams | BT, MA, FA, LW & TX | Less than Three Years | Rs 43,100 /- |

| IPCC (both) | 8 Exams | BT, MA, FA, TX & AA | Two years | Rs 56,200 /- |

| B.Com + IPCC | 7 Exams | BT, MA, FA, LW, TX & AA | One year | Rs 56,200 /- |

| CA (after 2003) | 4 Exams | BT, MA, FA, LW, PM, TX, FR, AA & FM | One year | Rs 87,600 /- |

The program is ideal for commerce undergraduates, graduates, MBAs, and aspiring or qualified chartered accountants

ACCA welcomes candidates from varied academic backgrounds, requiring only completion of 10+2 education

Optional work experience, allowing flexibility to complete a graduation degree and gain two years of experience within seven years of the program.

- ACCA stands for Association of Chartered Accountants

- It is a UK-based syndicate/group of qualified professional accountants which is over 100 years old

- It is globally recognised accounting qualification

- ACCA is recognised in 170+ countries including UK,UAE,Singapore and many more.

- ACCA jobs are available across the globe !

- To check, choose your desired country from the link below:

https://jobs.accaglobal.com/?utm_source=ACCAglobal&utm_medium=referral&utm_campaign=navbar1

- A Qualified CA gets exemptions of up to 9 papers just leaving 4 papers to appear for. VG Learning Destination provides scholarships of up to Rs 87,600/- for Qualified CAs.

- A CA IPCC student may get UPTO 9 exemptions ( 5 on the basis on IPCC+ others)!

- VG Learning Destination provides Scholarship upto Rs 56,200/- for CA IPCC students

- A B.Com graduate from a recognised university may get up to 4 exemptions.

- VG Learning Destination offers Scholarship upto Rs 43,100/- for B.Com graduates.

There are a total of 13 papers are there in ACCA, spread across 3 levels

- No there is no aggregation/grouping in ACCA. Students need to score 50% in each paper to pass.

- No, ACCA is completely flexible. Candidates can appear for any paper within the level in any sequence.

- ACCA exams are held 4 times a year

- The 1st four exams are ON –Demand and can be given at any time without waiting for the quarter.

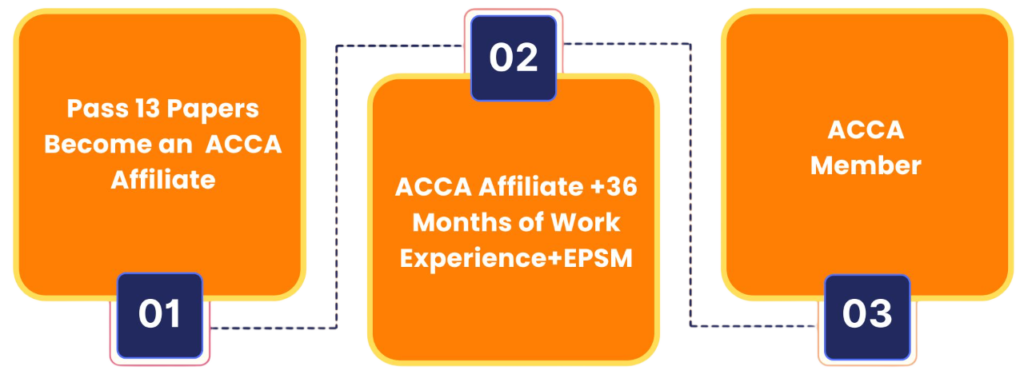

- Completing 3 E’s of ACCA, namely Exams, EPSM and Experience makes you an ACCA member

- A candidate must have 36 months of training in ACCA

- Yes, CA Articleship is recognised as ACCA PER

- The salary ranges from 4 lac to 14 lac depending upon the candidates skills and companies demand. Fresh Graduates earn around 4 lac(which is same for a CA) while the average salary is around 8 lac. There will be an increase in average salary in future as the demand for ACCA qualified candidates is on a steady rise.

- Yes, Scholarship upto Rs 88,000/- is available from Unique Global.

- Exemptions and Scholarships depend upon the your entry level Qualification in ACCA.

- Yes, students can start their ACCA journey right after their 10+2 examination.

- Yes, students from Class 11 & 12 Commerce can start with their ACCA journey with VG Learning Destination. They can avail of annual subscriptions, waiver benefits for 2 years and free ACCA registration.

- ACCA classes from VGLD are LIVE Online classes over the weekends with 100% back up

EY, PWC, Deloitte, Grant Thornton, BDO, Citibank, Protivity, Accenture, S and Martin and Amazon.

- Accounting, Finance, Audit & Assurance, Taxation, Insolvency,Forensic Accounting and many more…

| Parameters | CA | ACCA |

|---|---|---|

| Recognised | Only in India | Recognised in 180 countries |

| Flexibility | No Flexibility, Need to give in predefined groups | Complete Flexibility, can choose any paper within the level |

| No of papers | Need to attempt all papers in the group | Complete Flexibility- can choose a minimum of 1 paper in the level |

| Exam | Fixed tenure of CPT(4 papers in a day!!!) | Complete flexibility to choose first 4 exams as per own convenience |

| Frequency of Exams | Twice a year | Four times a year |

| Pass Rate | 40% Individual, 50% Aggregate Overall Passrate – 20% | Flat 50% in all , No Aggregation Overall Passrate – 60% |

| Training | 2 ½ Years training compulsory before you can attempt final level | No such requirement. Can do training at any time-Before, During, After completion( includes CA Articleship) |

| MBA | ACCA |

|---|---|

| Too many MBA’s graduating every year with lack of Employable Skill Set | ACCA, on the other hand, has a hands-on approach where the students can deal with high level of practical content rather than just theoretical concept. This approach paves the way for students to master various interpersonal skills. |

| Focusing on irrelevant subjects like Marketing ,IT etc is a waste of time and effort on the part of students | On the contrary, ACCA goes to the depths of accountancy and finance, in order to let you gain enough knowledge in the accounting field. |

| Starting level is from lower level in companies | ACCA’s can attract more senior roles at managerial or director level which will attribute in accelerating their careers |

We assist students to secure high end jobs in the big fours (E&Y, PwC, Delloite, KPMG) and MNC’s. ACCA program opens up doors for diverse career opportunities like below:

Employability in India/Placement Services

- ACCA has established mutual acknowledgment agreements with several key prestigious global accountancy bodies:

- The Certified General Accountants Association of Canada The Hong Kong Institute of Certified Public Accountants The Malaysian Institute of Certified Public Accountants UAE– AAA (Accountants and Auditors Association) CA Australia and New Zealand

- These agreements provide inexpensive routes for ACCA members to become a member of their bodies and appreciate the services that local organizations can offer.

The ACCA Exams are held 4 times in a year, generally in the first week of March June,September and December.

Exact date sheet is available at

https://www.accaglobal.com/in/en/student/exam-entry-and-administration.html

- ACCA has 2 Approved Content Providers: BPP and Kaplan.

- ACCA books are easily available online.

- We do not provide the Books in the registration fees but we do assist the students in where to place the order from.

As part of your journey to become a qualified ACCA member, a candidate must demonstrate relevant skills and experience within a real work environment. This is what PER (Practical Experience Requirement) is all about. To complete PER, you will need to:

achieve 36 months of supervised experience in a relevant accounting or finance role(s)

complete nine performance objectives (five Essentials and four Technical)

record your progress online in MyExperience

have your experience signed off by a practical experience supervisor.

The salary ranges from 4 lac to 14 lac depending upon the candidates skills and companies demand. Fresh Graduates earn around 4 lac(which is same for a CA) while the average salary is around 8 lac.

There will be an increase in average salary in future as the demand for ACCA qualified candidates is on a steady rise.