Excel in Your Career with Expert ACCA Classes!

The Association of Chartered Certified Accountants (ACCA) is the world’s leading professional accounting body, offering a globally recognized qualification. With over 230,000 members and half a million students worldwide, ACCA empowers finance professionals with the skills and knowledge to excel in today’s dynamic business environment.

What is the ACCA Course?

ACCA Course Details

| Eligibility Criteria for ACCA Course | |

|---|---|

| Educational Qualification: | ● Minimum Requirement: Completion of 10+2 (Senior Secondary) focusing on subjects like Accounting, Mathematics, or Economics. ● Graduates and postgraduates in commerce, finance, or related fields are also eligible. |

| Professional Background: | ● Experienced professionals in accounting and finance are eligible and may qualify for exemptions based on their prior qualifications. |

| Exemptions for Specific Qualifications: |

● Candidates holding relevant degrees or certifications (e.g., CA, MBA, CPA) may qualify for exemptions from specific ACCA exams, enabling them to complete the program more quickly. |

| No Age Limit: | ● There is no age restriction for enrolling in the ACCA program, making it accessible to students and professionals at any career stage. |

| English Language Proficiency: | ● As ACCA exams are conducted in English, a strong command of the language is recommended. However, it is not mandatory, as additional support may be available. |

| Global Access: | ● The program is open to candidates worldwide, with ACCA exams and study resources available globally. |

ACCA Course Syllabus

| ACCA Applied Knowledge | ACCA Applied Skills | ACCA Professional Level |

|---|---|---|

| Business & Technology (BT) | Corporate and Business Law (LW) | Strategic Business Leader (SBL) |

| Management Accounting (MA) | Performance Management (PM) | Strategic Business Reporting (SBR) |

| Financial Accounting (FA) | Taxation (TX) | Options (Pick any Two) |

| Financial Reporting (FR) | Advanced Financial Management (AFM) | |

| Audit & Assurance (AA) | Advanced Performance Management (APM) | |

| Financial Management (FM) | Advanced Taxation (ATX) | |

| Advanced Audit & Assurance (AAA) |

Careers and Opportunities after the ACCA Course

Master Global Financial Courses with Unique Global Education

Unique Global Education

ACCA Classes in Pune Offerings

| Offerings | Level 1 | Level 2 | Level 3 |

|---|---|---|---|

| Study Material | ✅ | ✅ | ✅ |

| Question Bank | ✅ | ✅ | ✅ |

| Personal Analysis | ✅ | ✅ | ✅ |

| Study Planner | ✅ | ✅ | ✅ |

| Jammer Session | ✅ | ✅ | ✅ |

| Mock Exams | ✅ | ✅ | ✅ |

| 100% Placement Assistance | ✅ | ✅ | ✅ |

| 150+ hours of Free Programs | ✅ | ✅ | ✅ |

| Study Material (Soft Copy) | ✅ | ✅ | ✅ |

| Unique Bridge Course | ✅ | ✅ | ✅ |

| Corporate Grooming Program | ✅ | ✅ | ✅ |

| Test Series | ✅ | ✅ | ✅ |

Endless Opportunities Await

Join Our Expert-Led Webinar

Enhance your skills and stay updated with our expert-led webinar. Learn from experts, engage in live sessions, and connect with a community of like-minded individuals.

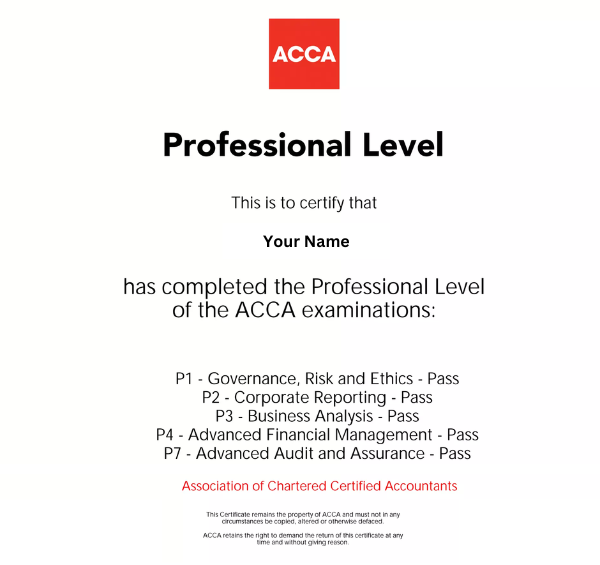

ACCA Certification

Earn the globally recognized ACCA certification with Unique Global Education. Whether you are aiming to advance your career or broaden your professional horizons, the ACCA certification is your gateway to accounting world.

Kickstart Your ACCA Journey Today!.

Download the ACCA Syllabus and Dive into Your Path to Excellence. Get the Complete Brochure Now: Discover all the essential details and strategic insights to set yourself up for success in the world of finance.

Offering 3 exclusive programs

absolutely FREE with your ACCA enrollment.

At Unique Global Education, through our ACCA classes in Pune, our Vision and Mission is to provide cutting-edge, industry-relevant programs that not only educate but also equip you to become highly employable professionals

- Accounting Terminologies Journal

- Accounting Rules

- Ledger

- Trial Balance

- P and I Account

- Balance sheet

Course Duration: 30-40 hours

- Basics in Finance

- Strong Grasp in Accounting Principles

- Accounting AS and ind AS

- Basics in Audit Techniques

- Basics in costing strategies

- Understanding Management Essential

Course Duration: 60-70 hours

- Communication skills

- Leadership skills

- Decision making skills

- Technical /Analytical skills

- Advance Excel/Word

- Power BI Tools

- Financial Modelling

- Equity Research

Course Duration: 60-70 hours

- Plan & Strategy for Revision and Marathon

- Time Management with Positive Mindset

- Real Exam based Question solving & Test

- Subjective Question Practice

- Typing Speed Practice

- Homework & Assignment

- Past Year Question Solving

- Full Syllabus multiple Mock Test

Course Duration: 60-70 hours

Frequently asked questions

ACCA (Global Focus)

● Recognized in 180+ countries with 252,500+ members worldwide.

● Covers financial reporting, taxation, management accounting, and ethics.

● Flexible exam schedule; takes ~3-4 years to complete.

● Preferred by 7,400+ global employers, ideal for multinational careers.

● Strong emphasis on ethics and international finance standards.

CA (National Focus, e.g., India)

● Highly respected within its country of certification (e.g., ICAI in India).

● Specializes in local financial regulations, taxation, and compliance.

● Structured program with a mandatory 3-year articleship; takes ~4-5 years.

● Valued by domestic firms, regulatory bodies, and national corporations.

Comparison:

● Global vs. Local: ACCA suits international careers, CA is best for domestic markets.

● Broad vs. Specialized: ACCA covers global finance, CA focuses on national laws.

● Flexible vs. Structured: ACCA offers flexible exams, CA follows a strict training path.

● Career Scope: ACCA is recognized by global firms, CA excels in local industries.

Yes, the ACCA qualification is recognized in more than 180 countries. Therefore, professionals who aim to work with multinational corporations worldwide prefer this qualification.

According to AmbitionBox, the average ACCA salary in India varies between ₹5-12 LPA, based on skills, experience, and the employer.

Definitely. Students from cities like Delhi, Bangalore, Hyderabad, Mumbai, and even abroad regularly attend Unique Global Education live online ACCA classes. You get the same expert faculty, personalized support, and exam success strategies—no matter where you’re located.

What makes Unique Global Education stand out is its blend of industry-backed teaching, individual mentoring, real-world application, and career focus. Unlike many institutes, Unique Global Education supports you from Day 1 of preparation to final job placement. You’re not just passing exams—you’re building a future.

ACCA (Association of Chartered Certified Accountants) is a global professional accounting qualification based in the UK, recognized in over 170 countries. It covers international accounting, finance, audit, taxation, and ethics. ACCA prepares you for high-paying roles in multinational companies and is considered one of the most respected credentials in global finance.

The ACCA course is structured into 13 exams, divided into three levels:

-

Applied Knowledge (3 papers)

-

Applied Skills (6 papers)

-

Strategic Professional (4 papers)

Additionally, students must complete the Ethics and Professional Skills Module (EPSM) and gain 36 months of relevant work experience. ACCA exams are held quarterly, offering flexibility to complete at your own pace.

Students who have completed Class 12. Graduates in commerce, CA aspirants, MBA finance students, and working professionals can also apply. Many are eligible for exemptions based on their prior education (e.g., B.Com or CA Inter can skip certain exams).

The ACCA qualification can be completed in 1.5 to 3 years, depending on your study pace, exemptions, and exam schedule. Students may attempt up to 4 papers per session, but most prefer 1–2 papers at a time for better retention.

Absolutely. With globalization, MNCs in India and abroad increasingly prefer professionals with international finance credentials. ACCA-qualified candidates are in demand across Big 4 firms (Deloitte, EY, PwC, KPMG), banking, fintech, and consulting domains. The career scope is wide and future-ready.

Yes, ACCA online courses are a popular and effective option. At Unique Global Education, we offer live and recorded lectures, doubt-solving sessions, mock tests, and mentor support—all accessible from anywhere in India.

Yes, our ACCA Online Classes are designed with flexibility in mind. We offer evening/weekend batches, unlimited playback, and mobile access, making it convenient for working professionals to balance job and studies effectively.

After completing ACCA, you can apply for positions like:

-

Financial Analyst

-

Internal/External Auditor

-

Tax Consultant

-

Risk Manager

-

Finance Manager

-

CFO (with experience)

-

Management Accountant

These roles are available in India and globally, with attractive starting salaries ranging from ₹5 to ₹10+ LPA depending on your experience and company.

Yes, ACCA is valid and highly respected in 170+ countries, including the UK, UAE, Singapore, Australia, Canada, and more. It’s one of the most portable qualifications in accounting and finance.

If you’re a B.Com, CA Inter, CA Finalist, MBA Finance, or ICWA, you may get exemptions from certain exams—up to 9 papers depending on your background. This significantly reduces the time and cost of completing ACCA.

At Unique Global Education, we focus not just on exam prep but also on real-world skills. You get:

-

Expert Mentors with global exposure

-

Personalized Study Plans

-

Regular Mock Tests

-

Interview & Resume Support

-

Career Counseling

Our hybrid learning model (face-to-face + online) ensures full flexibility without compromising quality.

Our students consistently secure high pass rates, and many have achieved All India Ranks (AIR). We have placed students in Big 4 firms and MNCs, thanks to our focused preparation and dedicated mentorship.

Yes, we offer placement assistance, interview preparation, resume building, and internship opportunities to help our students secure top jobs even before completing the course.

You get access to:

-

Live Lectures

-

Recorded Videos

-

Digital Notes & Question Banks

-

Weekly Practice Tests

-

One-on-One Mentorship

-

Whatsapp Group Support

These ensure you are exam-ready and confident in your concepts.

ACCA exams are held four times a year (March, June, September, December). You can attempt up to 4 papers per session and 8 papers per year.

Yes. ACCA’s flexible structure and Unique Global Education online ACCA classes make it possible to balance ACCA with a job or college. You can take one paper at a time, based on your schedule.

While there is no strict time limit, it is recommended to complete ACCA within 7 years of passing the first exam. Strategic Professional exams must be completed within 7 years of passing any paper from that level.

Simply fill the inquiry form or call/WhatsApp us. Our counselors will guide you through:

-

Eligibility Check

-

Scholarship Process

-

Registration

-

Batch Allotment

-

Access to LMS and Materials

You can also walk into our center in Pune for a free consultation session.

Email : info@uniqueglobaleducation.com

Phone : 9307319507 / 7219143428

Whats’app : 9307319507

Address : Shop No 25, Kumar Prestige Point, Near Chinchechi Talim, Behind BSNL Telephone Exchange, Shukrwar Peth, Bajirao Road, Pune-411002