What is CFA Course

CFA stands for Chartered Financial Analyst (CFA) ‘Gold Standard’ and the most prestigious CFA® certification is offered by the CFA Institute. The cfa course duration is usually 3 to 4 years and serves as a global entry point for very lucrative finance opportunities. and CFA is in 3 levels (Level I, Level II, and Level III) The CFA® course covers many areas of study such as advanced investment probability theory, analysis, fixed income derivatives, corporate finance, statistics, alternative investments, and portfolio management.

How to Become CFA in India ?

To become a CFA® charterholder in India, candidates must pass all three CFA exam levels, meet the required work experience criteria, and apply for CFA Institute membership as per global standards.

Eligibility For CFA– Your Path to Excellence

- CFA After Graduation:

Candidates holding a bachelor’s degree in any stream are eligible to register for the CFA® Program and appear for CFA exams. - Students Before Graduation:

Students who are within 23 months of completing their graduation can register for CFA Level I, allowing them to start the program early. - CFA After 12th:

You cannot appear for the CFA exam immediately after Class 12. However, students can begin CFA preparation after 12th to build a strong foundation. - CFA Age Limit:

There is no age limit to pursue the CFA course, making it suitable for both fresh graduates and working professionals. - Work Experience Requirement:

No work experience is required to appear for CFA exams. However, candidates must complete 4,000 hours of relevant work experience to earn the CFA charter.

Other CFA Requirements:

A valid international passport and English language proficiency are mandatory to register for the CFA® Program.

Roles & Responsibilities of a CFA® Professional

CFA professionals play a critical role in investment decision-making, financial planning, and risk management across global financial markets. Their expertise helps individuals and organizations make informed, data-driven financial decisions.

| Key Role | Core Responsibilities |

|---|---|

| Investment Analysis | Analyzing financial statements, evaluating economic trends, and assessing the risk–return profile of investment opportunities to support informed decisions. |

| Portfolio Management | Constructing, managing, and recommending investment portfolios aligned with client objectives, time horizon, and risk tolerance. |

| Financial Planning | Developing long-term financial strategies for individuals and businesses, covering investments, cash flow, and wealth management goals. |

| Risk Management | Identifying financial risks and creating risk mitigation and contingency plans to protect organizations from market volatility. |

| Mergers & Acquisitions (M&A) | Providing valuation, due diligence, and advisory support during mergers, acquisitions, and corporate restructuring. |

| Financial Reporting & Compliance | Ensuring financial reporting aligns with accounting standards, regulatory requirements, and ethical guidelines. |

| Financial Modelling & Valuation | Building financial models and performing business valuation to support strategic and investment decisions. |

CFA Course Syllabus

The CFA syllabus is designed to build a strong foundation in investment management, ethics, and financial analysis. Spread across CFA Level I, Level II, and Level III, the syllabus progressively develops analytical, valuation, and portfolio management skills required for global finance roles.

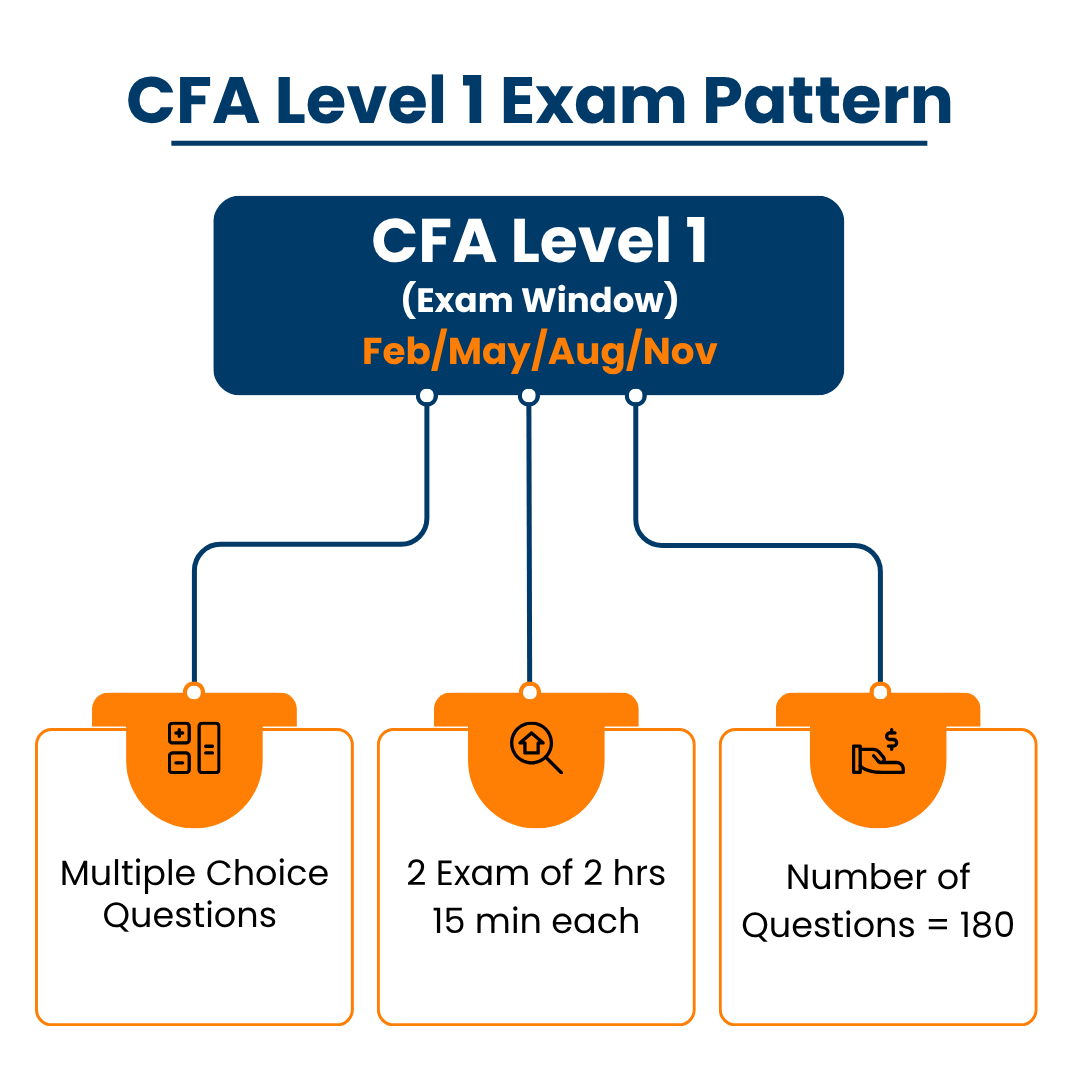

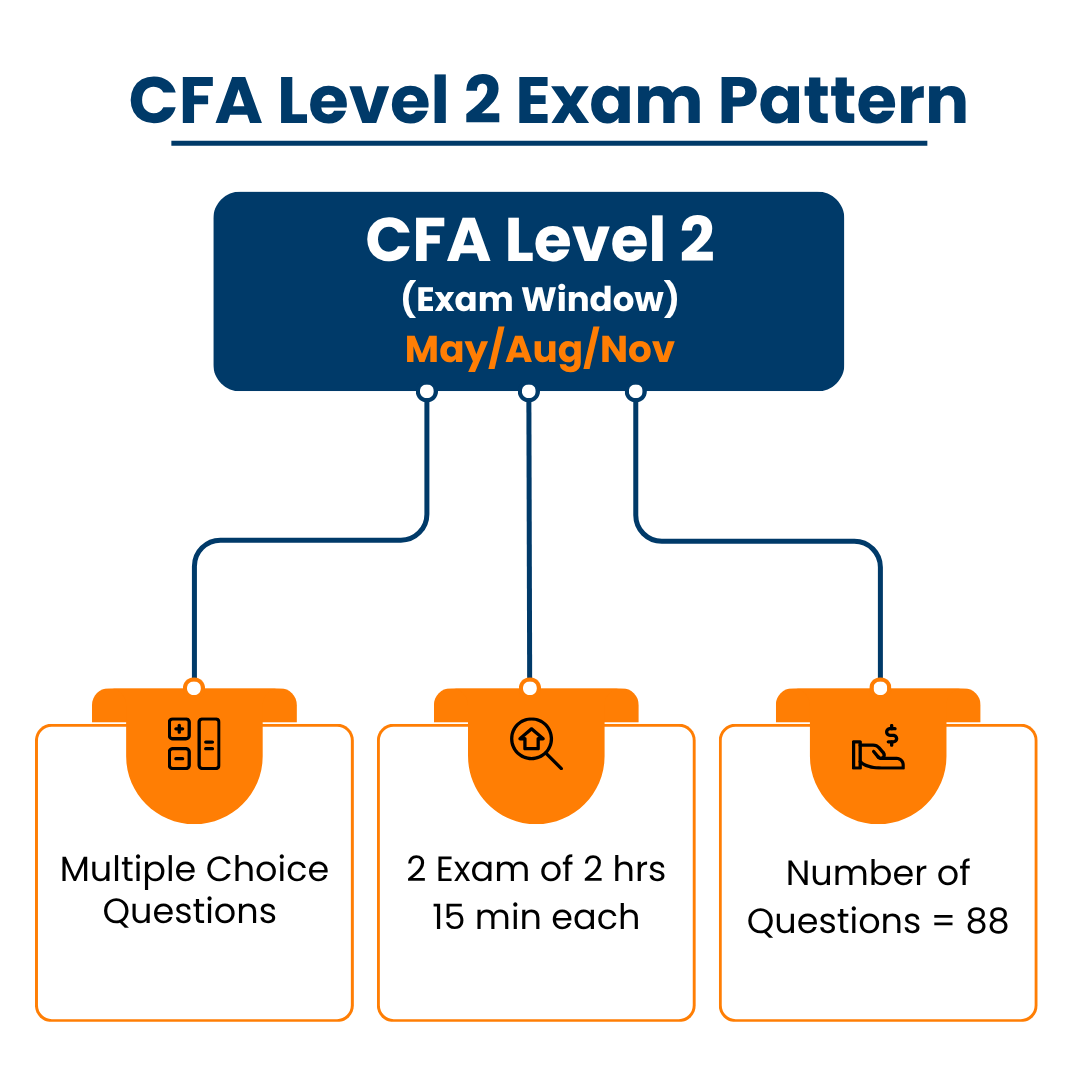

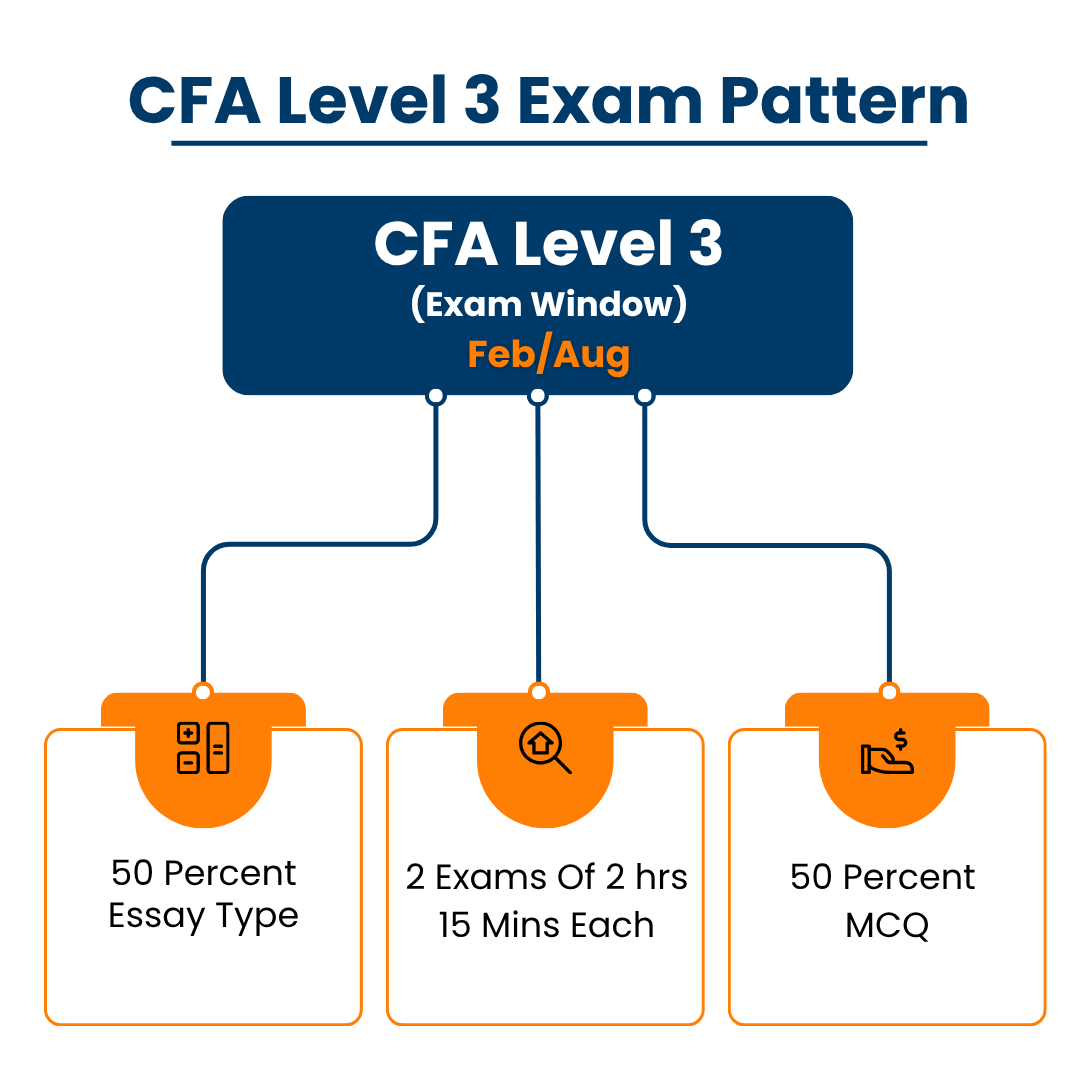

CFA Exam Pattern

The CFA exam pattern varies across CFA Level I, Level II, and Level III, with differences in question format, structure, and assessment style. Understanding the CFA exam structure helps candidates prepare effectively for each level.

| Feature | CFA Level I | CFA Level II | CFA Level III |

|---|---|---|---|

| Exam type | Multiple Choice (MCQ) | Case-based MCQs | Essay + MCQs |

| Total exam time | 4 hrs 24 mins | 4 hrs 24 mins | 4 hrs 24 mins |

| Number of questions | 180 | 88 | Mixed |

| Exam months | Feb, May, Aug, Nov | May, Aug, Nov | Feb, Aug |

| Negative marking | No | No | No |

The CFA Institute may update exam windows and formats, so candidates should always verify details before registration.

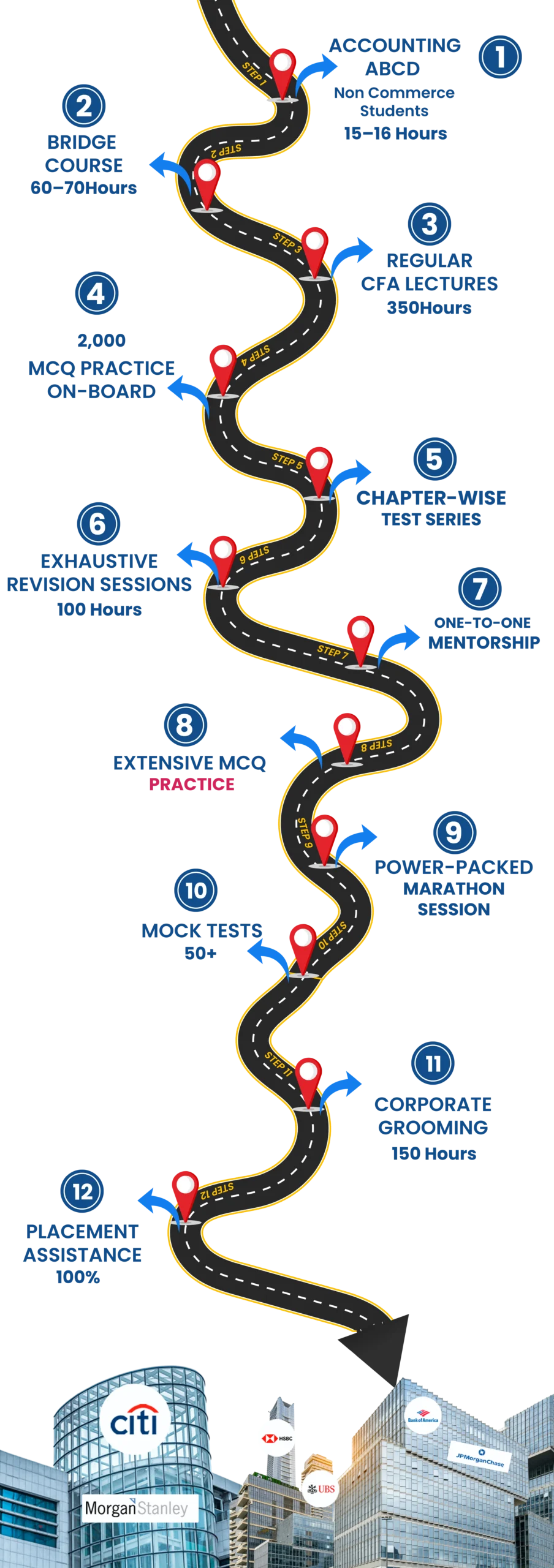

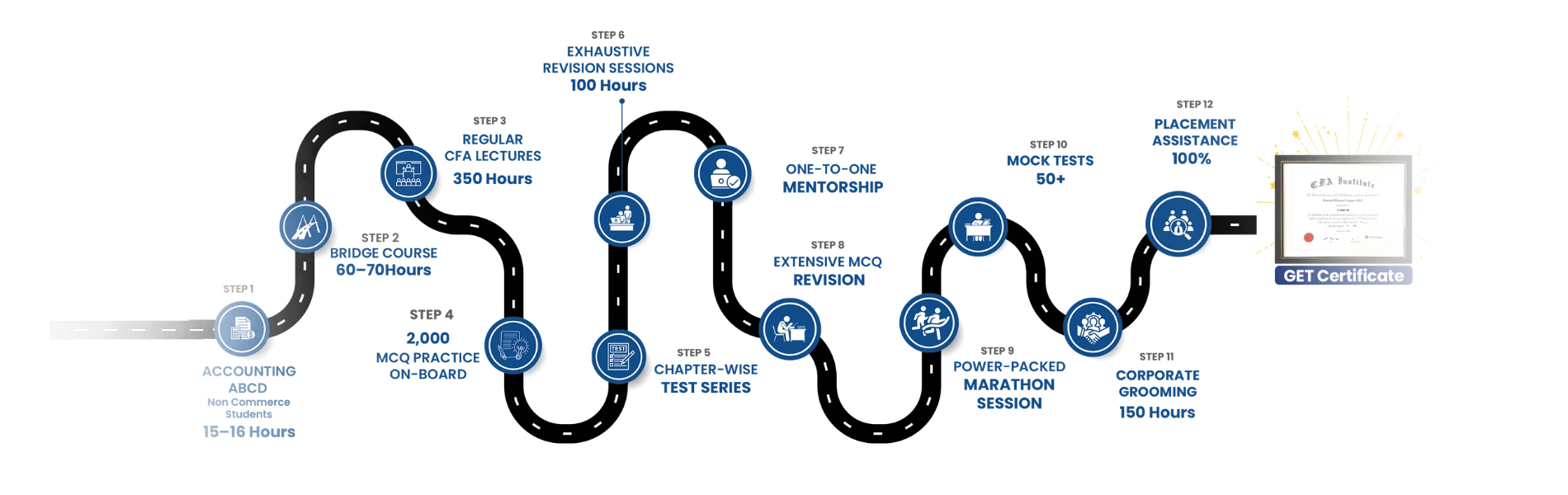

CFA– Unique Roadmap

CFA– Unique Roadmap

Corporate Grooming Program (150 Hrs) worth Rs. 1.5 Lacs – Absolutely FREE

Access Our FREE Educational Materials

- Accounting Terminologies Journal

- Accounting Rules

- Ledger

- Trial Balance

- P and I Account

- Balance sheet

- Basics in Finance

- Strong Grasp in Accounting Principles

- Accounting AS and ind AS

- Basics in Audit Techniques.

- Basics in costing strategies.

- Understanding Management Essential

- Communication skills

- Leadership skills

- Decision making skills

- Technical skills

- Analytical skills

- Advance Excel

- Advance Word

- Powerpoint

- Power BI Tools

- Plan & Strategy for Revision and Marathon

- Time Management with Positive Mindset

- Real Exam based Question solving & Test

- Subjective Question Practice

- Typing Speed Practice

- Homework & Assignment

- Past Year Question Solving

- Full Syllabus multiple Mock Test

Why Become a CFA® Charterholder?

Becoming a CFA® charterholder offers global recognition, strong career growth, and in-demand investment management skills. The CFA designation is widely respected by employers across finance, asset management, and investment roles worldwide.

Career Opportunities After CFA Certification

Become a CFA certified professional and excel in top finance roles globally.

Salaries vary based on experience, location, and employer. Figures are indicative averages based on industry data.

Trusted by Students, Driven by CFA Success Stories

UGE Alumni Work Here,You Could To

Kickstart Your CFA Journey Today!

Ready to Transform Your Career

Frequently Asked Questions

The CFA (Chartered Financial Analyst) course is a professional certification in finance, investment management, portfolio management, and financial analysis, offered by the CFA Institute (USA). It is globally recognized in the finance industry.

The full form of CFA is Chartered Financial Analyst.

You can do CFA if you:

- Are in the final year of graduation, or

- Have completed graduation, or

Have a combination of education and work experience (as per CFA Institute

- To become a CFA in India, you need to:

- Register for the CFA Level I exam

- Clear Level I, Level II, and Level III

- Gain required work experience in the investment/finance field

- Apply for CFA Institute membership

- There are three levels in the CFA® certification:

- Level I – Basics of finance and investment concepts

- Level II – Application and analysis

Level III – Portfolio management and wealth planning

- No. You cannot directly enroll in CFA after 12th.

You must be:- In the final year of graduation, or

- Have relevant work experience that meets CFA eligibility criteria

Yes. CFA after BCom is a strong career option if you are interested in:

- Investment banking

- Equity research

- Portfolio management

- Financial analysis

It adds global credibility and improves job opportunities in India and abroad.

To earn the CFA charter, you need 4,000 hours of relevant work experience completed over at least 36 months.

This experience can be gained before, during, or after completing the CFA exams and is valid in India.