The Certified Management Accountant (CMA) is a highly respected credential in finance and accounting, and CMA salary ranges are strong based on the industry, company size, and experience. CMAs Remain in Demand in the US: 2025 Due to the ongoing demand for the CMAs, organisations in the US are looking for accounting experts who also have a strategic understanding of business.

In this blog post, we’ll discuss the Top 10 CMA jobs in the USA and what will be the average salary and job outlook in 2025 so that you can prepare yourself.

Table of Contents

Why CMA?

But, before we start looking at job titles, let’s take a brief look at the why behind the importance of a CMA:

- CMAs are experts in financial planning, analysis, control, decision support, and professional ethics.

- The CMA designation is your ticket into a leadership and strategic position.

- When it comes to CMA salary, the IMA says that CMAs make an average of 58% more than their non-CMA counterparts.

- The title of CMA (like CFO or CEO) is an acronym used by thousands of firms across dozens of industries: tech, health care, manufacturing, banking, you name it.

Now here’s a rundown of the top jobs in the USA in 2025:

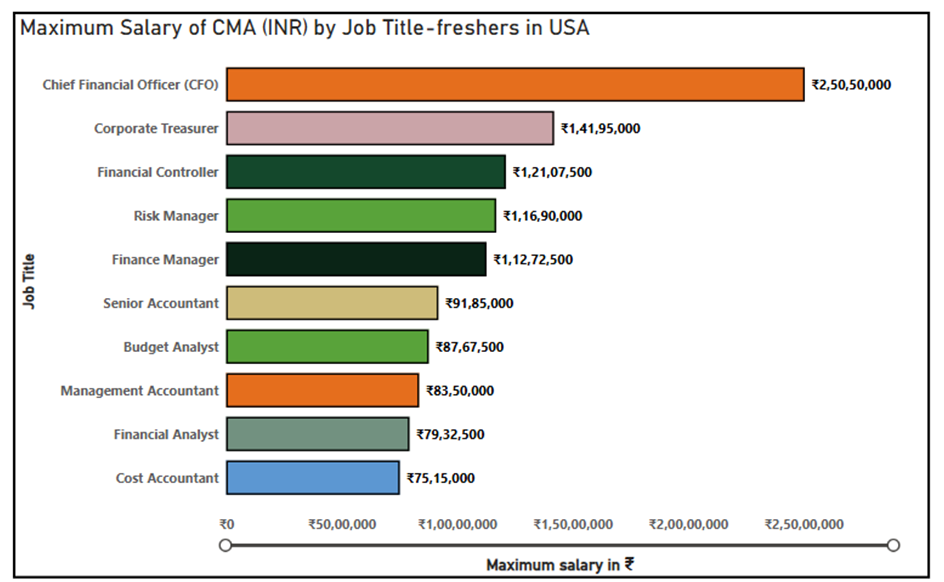

1. Financial Analyst

- Role:

Financial analysts assist their company or clients in making investment decisions. They also study financial information, statistics and market data in order to inform business strategy.

- Salary (2025):

$75,000 – $95,000 per annum

- Why It’s Great:

It’s a good entry-level position for new CMAs. It will expose you to the logic of budgeting and forecasting which is central to CMA skills.

2. Cost Accountant

- Role:

Cost accountants monitor and analyse costs associated with production of goods or services. They offer valuable information to cut costs and increase efficiency.

- Salary (2025):

$70,000 – $90,000 per annum

- Why It’s Great:

CMA curriculum is very cost-centric. Youwill be well prepared for this task; in production-intensive states like Texas and Ohio, in particular.

3. Management Accountant

- Role:

Management accountants (also called managerial accountants) look at the events that happen in and around a business while considering the needs of the business.

- Salary (2025):

$80,000 – $100,000 per annum

- Why It’s Great:

It’s one of the most seamless transitions for CMAs and leads to controller and CFO positions in the long-term.

4. Financial Controller

- Role:

Controllers are responsible for every single accounting task within an organization; financial reporting, compliance, budgeting, and internal controls.

- Salary (2025):

$110,000 – $145,000 per annum

- Why It’s Great:

This is strategic work for a senior individual with control system, ethics, and compliance expertise from CMA.

5. Budget Analyst

- Role:

Budget Analysts Budget analysts help plan and manage an organization’s finances. They are the people to whom we entrust the efficient distribution of resources.

- Salary (2025):

$80,000 – $105,000 per annum

- Why It’s Great:

This role will enable you to utilise your budgeting experience and managerial performance review from your CMA studies – making a real, bottom line, impact to a huge multinational organisation.

6. Corporate Treasurer

- Role:

A corporate treasurer oversees acompany’s liquidity, investments, and financial risk associated with those activities. It’s a financeposition for strategy.

- Salary (2025):

$130,000 – $170,000 per annum

- Why It’s Great:

This could be ideal for CMAs who have a couple years’ experience. Risk assessment and working capital management are important here.

7. Risk Manager

- Role:

Risk managers analyse, manage and evaluate financial risks, as well as operational risks that could impact an organization’s overall performance.

- Salary (2025):

$105,000 – $140,000 per annum

- Why It’s Great:

Risk analysis is part of a broader CMA program of study, so it is a logical next step. Amid heightened concerns about cyber security and economic exposure, demand is increasing.

8. Senior Accountant

- Role:

Senior accountants’ duties include managing the daily accounting activities, preparing financial statements, and completing financial audits.

- Salary (2025):

$85,000 – $110,000 per annum

- Why It’s Great:

This job is appropriate for midcareer professionals, and a steppingstone to management roles such as controller or finance manager.

9. Finance Manager

- Role:

Finance managers are responsible for the financial health of an organization through investment activities and long-term financial planning as well as overseeing the functions of clients and staff.

- Salary (2025):

$100,000 – $135,000 per annum

- Why It’s Great:

Your CMA financial planning and controlfoundation can help guide finance teams and advise key executives.

10. Chief Financial Officer (CFO)

- Role:

A CFO is a top financial officer within the company. They oversee the company’s overall financial strategy and are an important part of the leadership team.

- Salary (2025):

$180,000 – $300,000+ a year (based on company size)

- Why It’s Great:

This is not an entry-level job, though; you would be an ideal candidate, of course, if you had between 10 and 15 years’ experience as a CMA. CMAs make up many of the CFOs in the F500.

Get Details for US CMA Online & Face to Face Batches

Industries Hiring CMAs in 2025

The following are the leading sectors in the US currently hiring CMAs as of 2025:

- Technology – Microsoft, Google, Meta hire CMAs for financial leadership.

- Healthcare -Hospitals and pharma companies are searching for cost experts.

- Manufacturing – CMAs also play a crucial role in budgeting, pricing and cost control.

- Banking & Financial Services – There is an increase in compliance and risk management roles.

- Consulting & Advisory – Again MNCs such as Deloitte and EY love CMAs when it comes to FP&A services.

CMA Career Outlook for 2025 and Beyond

Thecapacity for CMAs in the USA is estimated to increase by 15–20% by 2030 because:

- Increased emphasis on evidence-based decision-making

- AI and analytics included infinancial planning

- Importance of strong internalcontrols post COVID-19

- Globalisation and the complexity of cross-border tax

Final Thoughts

CMA certified opens the doors to lucrative, strategic roles in accountingand finance industry. Whether you are just starting-out or moving on to managing and commanding the people — the certification places you at the confluence of accounting and management/strategy.

Whether you will begin your CMA journey in 2025 or later, the US job market holds plenty of opportunity. These are good-paying jobs that provide opportunities forlong-term career growth and stability.

Planning to earn your CMA?

Begin today and future-proof yourself in finance. Enrol in a CMA training course, reach out to mentors and begin to apply to high potential jobs in the US.

Curious about CMA career paths?

Leave them in the comments or sign up for our newsletter to have them answered on our weekly post on global CMA openings.

Get Details for US CMA Online & Face to Face Batches