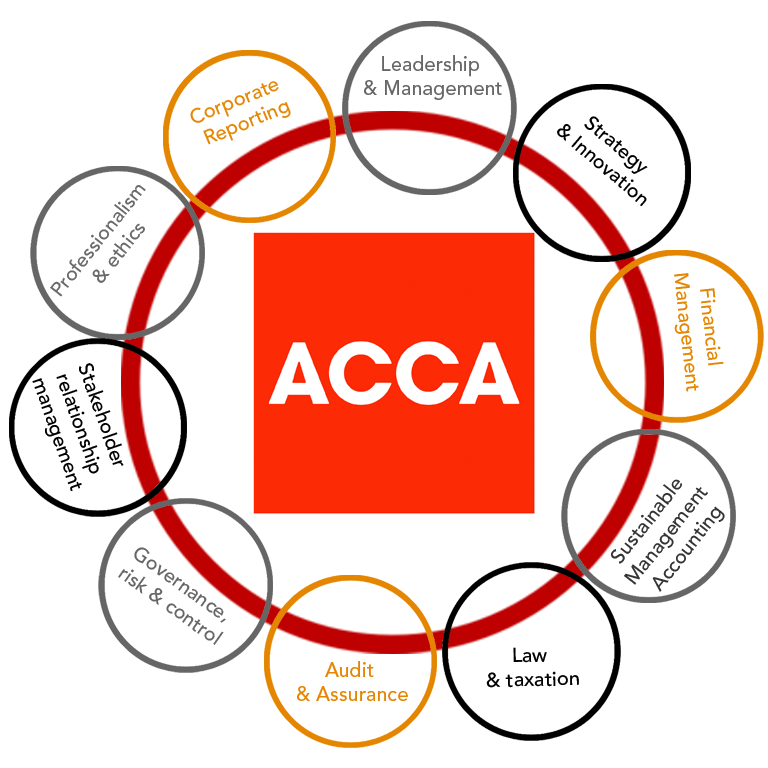

Association of Chartered Certified Accountants (ACCA) is a worldwide-recognised professional accounting membership that provides candidates with the expertise and skills required to establish a career in accounting, finance and business. There are three levels in the ACCA qualification:

- Applied Knowledge Level

- Applied Skills Level

- Strategic Professional Level

In this blog, we’ll narrow down our focus to the Applied Skills Level, also known as the ACCA Skill Level. The level provides the foundation for core accounting and finance concepts and the challenges faced by candidates in actual investment and business-related problems.

Table of Contents

Overview of ACCA Skill Level

ACCA skill level: the second ACCA qualification level that develops the candidate’s technical knowledge, problem-solving ability, and analytical skills in key areas related to finance, taxation, and corporate governance.

This level has six compulsory exams that cover a wide variety of accounting and financial concepts. This helps professionals in meeting the competency requirements for ACCA Strategic Professional Level or to help them take up senior roles in the organization.

The importance of the ACCA Skill Level

- Closes the gap between theory and practice

- Helps candidates meet real-world business challenges

- These are essential technical skills for financial professionals

- Derive strong analytical as well as decision-making skills bestows employability

Exams in ACCA Skill Level

The ACCA Skill Level consists of six exams which aim to test the candidates on all aspects of financial and business management. Let’s follow through them to understand each better:

1. Business Law (LW)

This is a subject that deals with the laws that apply to businesses and corporations. The syllabus includes:

- Basic principles of contract law

- Principles of corporate governance

- Employment law

- Business telephone services and some legal implications

- Building and Charting the Companies

How is this relevant to the topic at hand?

In the world of finance and accounting, understanding business law is crucial since accountants must ensure that their clients comply with corporate or business laws to avoid any possible legal disputes so that they can advise them accurately about any legal matters.

2. Performance Management (PM)

What is Performance Management? Performance Management streamlines accounting techniques to enable business decisions. The syllabus includes:

- Methods of costing and methods of pricing

- Budgeting and forecasting

- Variance analysis

- Metrics and measurement techniques

- Risk management

This topic is a significant relevant topic because,

They use their knowledge of performance management to help the companies increase efficiency, reduce costs, and drive performance through financial planning.

Get More Details Face to Face ACCA Classes in Pune & ACCA Online Classes

3. Taxation (TX)

So, this paper is basically all about taxation systems and all their applications in different scenarios. The syllabus includes:

- Principles of taxation

- Computation of Income tax for individuals & business

- Corporate tax, VAT and capital gains tax

- Tax planning strategies

- Domestic and international taxation principles

Why is this topic relevant?

Businesses require tax professionals in managing tax liabilities, regulatory compliance and reducing the tax burden through legal tax planning.

4. Financial Reporting (FR)

This paper develops skills to prepare financial statements in accordance with (i.e., comply with) International Financial Reporting Standards (IFRS). The syllabus includes:

- Preparation of financial statements

- The analysis and interpretation of financial statements

- Consolidated financial statements

- The balance of assets and liabilities

- Ethical and professional issues in relation to financial reporting

Why Does This Topic Matter?

Financial reporting is important for organizations because it ensures transparency, adheres to regulatory requirements, and informs decision-making.

5. Audit and Assurance (AA)

Principles of auditing and assurance engagements. The syllabus includes:

- Standards for audit and regulatory frameworks

- Internal controls and risk management

- Audit planning and procedures

- Reporting audit findings

- Ethical issues in auditing

Why is this topic significant?

By doing so auditors are key in providing reliable and trustworthy financial statements that are free from material misstatement and regulatory compliant which thereby induce confidence towards the investors.

6. Financial Management (FM)

This paper better prepares candidates to make inform strategic decisions about their finances. The syllabus includes:

- Analysis and decision making in finance

- Capital investment appraisal

- Working capital management

- Business financing options

- Management of risk and financial strategy

Why is this topic relevant?

Financial management skills are also necessary in order to sustain the business and also for making profits or investing the profits smartly.

Exam Format and Passing Criteria

Exam Format:

- Each exam is computer-based.

- Duration: 3 hours.

- These are called objective test questions (or multiple-choice questions or true-false questions), and constructed response questions.

- The Corporate and Business Law (LW) paper is 100% objective, with the remainder of the five exam papers based upon scenarios and case studies.

Passing Criteria:

Candidates need to score at least 50% on each exam to pass. As the exams gauge your knowledge and application skills, it is important to prepare well and practice case-based questions.

General Tips for ACCA Skill Level Study

- Understand the Exam Structure

All the tests have different structures, question types, and grading patterns.

- Master Key Concepts

The ACCA exams are designed not to be a simple memory test, so always focus on the core principles.

The study materials and past exam papers are ACCA approved.

- Practice Past Papers

The process of solving past exam questions enhance question pattern recognition, time management and highlights weak areas.

- Using Concepts in Real Life

Attempt to correlate theoretical concepts to practical business events; it helps in developing your analytical and decision-making abilities.

- Be in the know about IFRS and tax regulations

Since ACCA is a global accounting standard, it will be important to be updated with IFRS changes and tax laws to score well in exams related to it.

- Participate in Study Groups or Coaching

Better retention of concepts is achieved through group discussions.

An ACCA-approved coaching program offers expert guidance and structured study plans to aid candidates in their preparation for the exams.

Career Opportunities After ACCA Skill Level

Many career paths are available for candidates after they complete the Skill Level, such as:

- Financial Analyst

- Management Accountant

- Tax Consultant

- Internal Auditor

- Financial Controller

- Risk Manager

This means that while the ACCA Skill Level can improve chances of landing a job, your goal should be to complete the Strategic Professional Level in order to be considered a fully qualified ACCA member.

Conclusion

The ACCA Skill Level is an important milestone to becoming a world-renowned finance expert. It helps qualifying candidates gain hands-on knowledge in areas like financial management, taxation, performance management, auditing, and business law.

These six exams not only enhance candidates’ career prospects, but also serve as the foundation for the Strategic Professional Level, with the ultimate goal of becoming an ACCA member.

For students preparing for ACCA or planning to enrol, building conceptual clarity, regular practice, and application-based learning will help one excel in this stage and move closer to qualifying as an ACCA professional.

Get More Details Face to Face ACCA Classes in Pune & ACCA Online Classes